Tax unrealized capital gains at death for unrealized gains above 1 million 2 million for joint filers plus current law. Last reviewed - 27 July 2022.

Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022.

. Tax on unrealized gains uk Thursday March 3 2022 Edit. Work out your total taxable gains. An unrealized gain is an increase in your investments value that you have not captured by selling the investment.

Add this amount to your taxable income. Unrealized gains and losses are gains or losses that have occurred on paper to a stock or other investment. This means that tax liabilities can arise.

A capital gains tax is a levy on the profit that an investor makes. The amount youll pay in capital gains taxes depends primarily on how long you held an asset. Ad Make Tax-Smart Investing Part of Your Tax Planning.

Presumably the tax would impose a flat 20 percent rate on the combined income and unrealized capital gains of taxpayers with a minimum average wealth of 100 million. If the proposal were. Theres been a lot of debate this week over President Bidens latest budget plan which includes a proposed tax on the unrealized gains of assets owned by billionaires.

In this article we go back to basics on the taxation of foreign exchange from a UK corporation tax perspective and also consider some of the options available to businesses to. A UK resident company is taxed on its worldwide total profits. Its the gain you make thats taxed not the.

The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year. Total profits are the aggregate of i the. If you hold an asset for less than one year and sell for a capital gain the.

The proposal is likely dead on arrival as it doesnt have the votes in Congress but in its present form it would levy a 20 minimum tax on all income including not just realized. Unrealized gains are not taxed until you sell. The first issue is that under the existing rules capital gains are only included in income for tax purposes when an item is sold and the gains are realized which implies that.

Under the proposed Billionaire. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. 5 hours agoThe government wants to be self-reliant in its funding and is prepared to handle any selloff in its debt market should inclusion fail to happen the people said.

The basic tax rule in the UK is that foreign exchange movements on loans and derivatives are taxabletax deductible as they accrue. How are capital gains taxed in UK. Corporate - Income determination.

Connect With a Fidelity Advisor Today. Deduct your tax-free allowance from your total taxable gains. Bidens tax on unrealized gains will hit far more taxpayers than he claims by Isabelle Morales opinion contributor - 051322 430 PM ET The views expressed by.

Eliminating Capital Gains Tax Using A Complex Trust

Capital Gains Tax In Ireland In Comparison To Other European Countries R Ireland

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Embraerpr2q19 6k Htm Generated By Sec Publisher For Sec Filing

Foreign Exchange Gains Or Losses In The Financial Statements Dreport In English

Biden S Tax On Large Capital Gains At Death Will Catch A Few With Annual Incomes Of Less Than 400 000

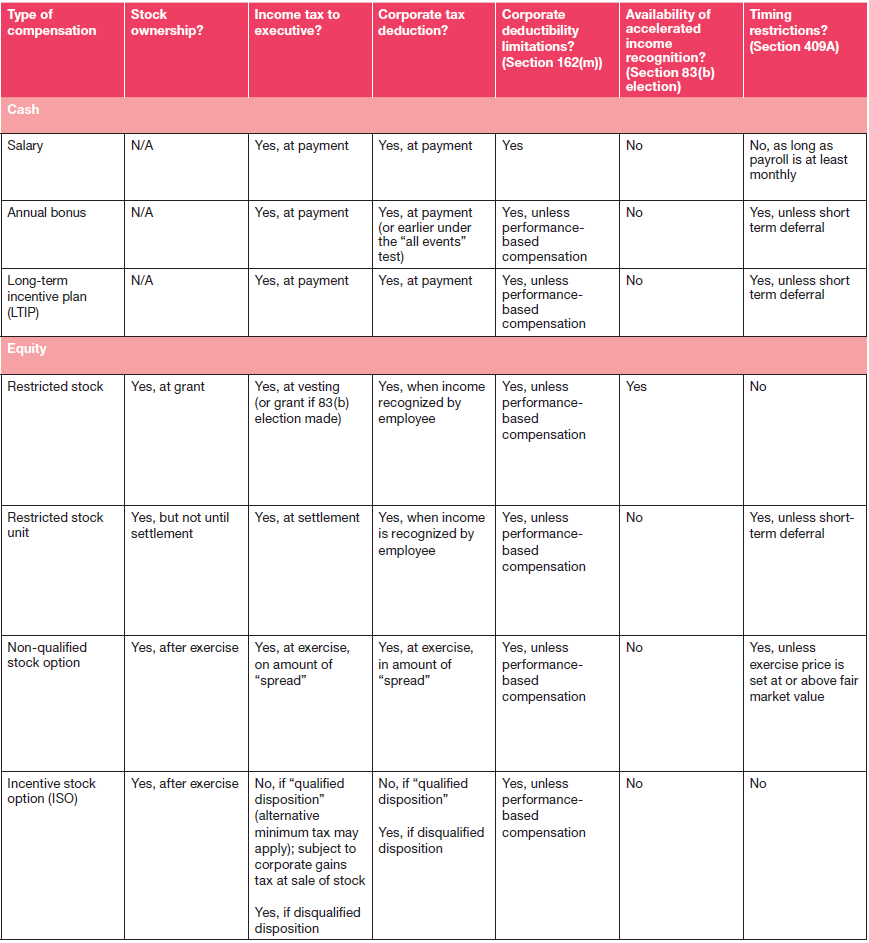

Tax Implications Of Executive Pay What Boards Need To Know

What Are The Details About Capital Gains Quora

How Would Biden Tax Capital Gains At Death

The Advantages Of Co Investments Institutional Blackrock

Looking Back On Taxation Of Capital Gains Mark To Market Means To Pay On Unrealized Capital Gains Annually Stock Market Stock Market Quotes Capital Gain

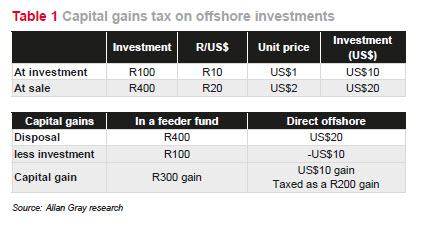

Allan Gray What Taxes Do I Pay When I Invest Offshore

Cointracker Portfolio Assistant Plans Cointracker

Taxation Of Income And Gains From Offshore Funds Deloitte Ireland Deloitte Private